Move From Data Collection to Data Connection

With the real estate industry’s leading data management and insights platform.

Build With Cherre

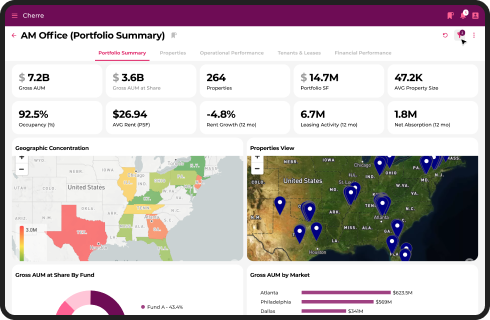

Leverage all your connected data to unlock sustainable competitive advantages.

Build a flexible data architecture that supports rapid innovation with unified data at the core. Empower data science teams to start with clean and standardized data.

Easily scale and add new capabilities through new datasets and information. Grow without disrupting your existing data infrastructure.

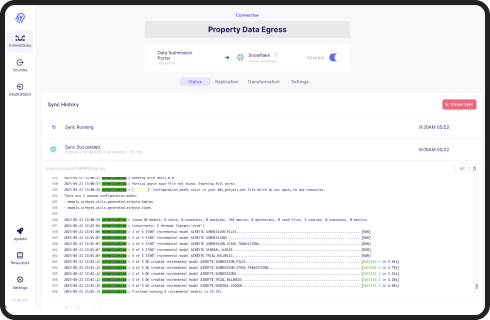

Use Cherre’s pre-built connectors to accelerate your roadmap for adding application, system, and subscription data to a central data warehouse. Reduce the required resources needed to analyze data for informed decision making.

Seamlessly ingest, connect, and consume all of your real estate data across the organization.

Cherre’s platform offers secure and flexible data ingress options:

Cherre’s extensive application partner network makes it easy to connect and ingest data from key internal systems such as ERP solutions, deal management platforms, leasing platforms and more.

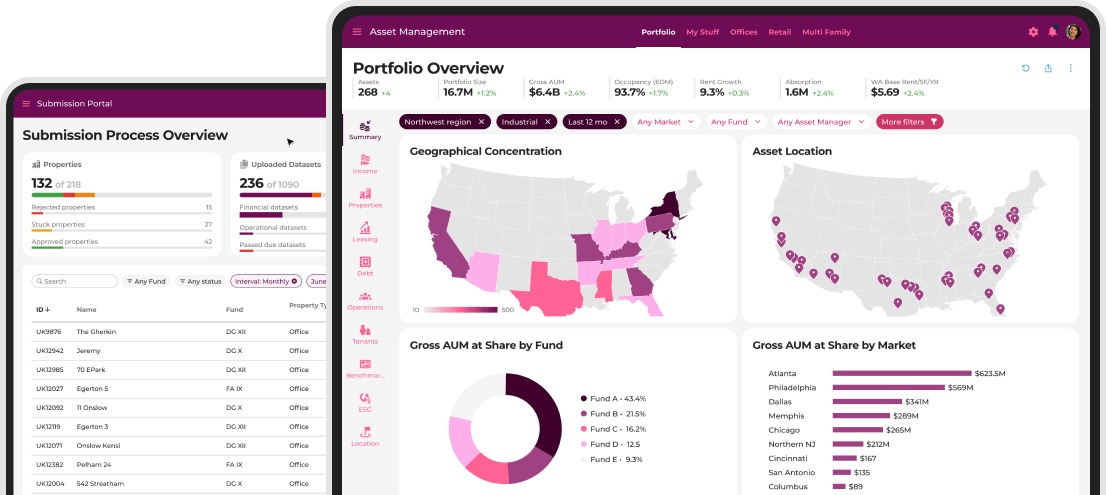

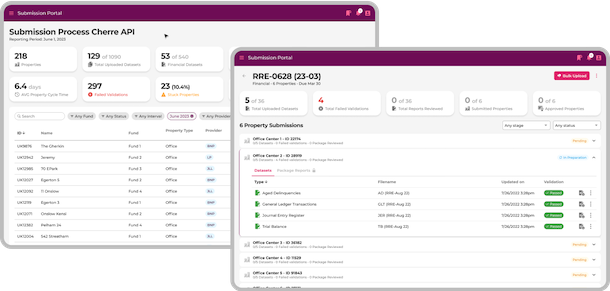

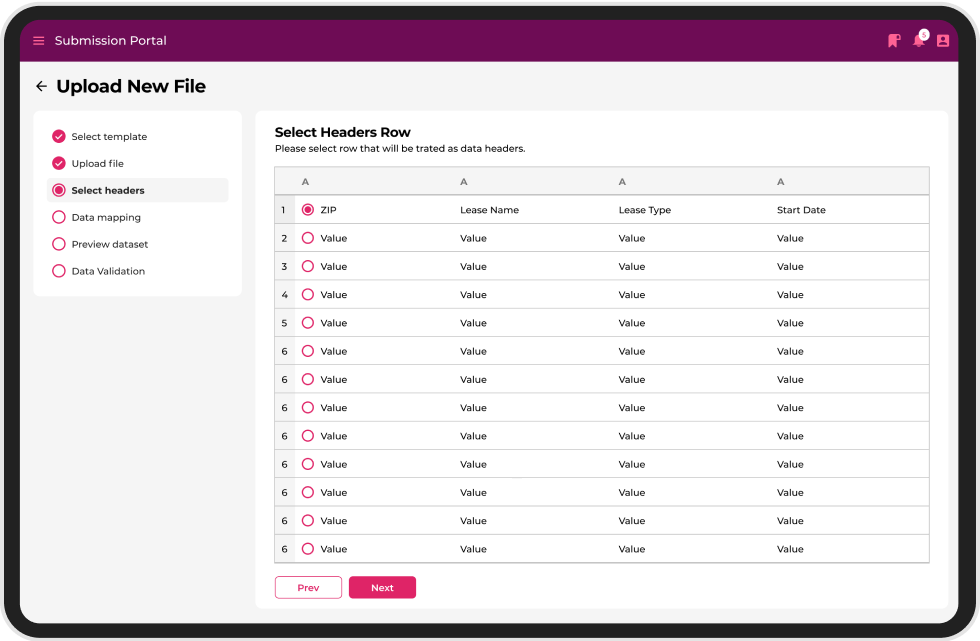

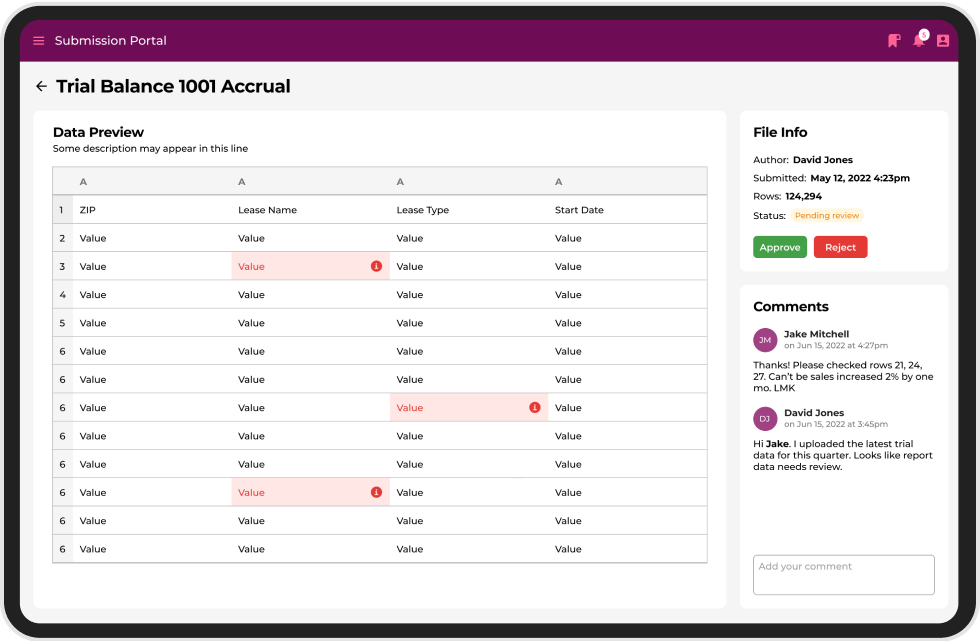

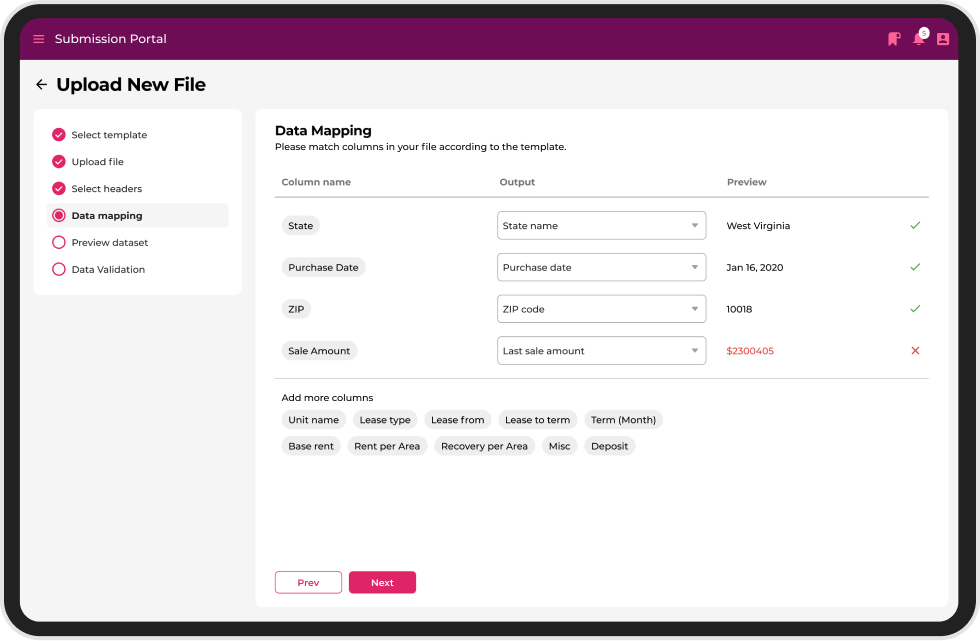

Cherre's Submission Portal streamlines and standardizes data collection from third-party vendors and investment managers. Map your data and set rules to automate data ingestion, standardization, and validation.

Cherre’s secure SFTP enables your managed service providers to submit data to Cherre for ingestion, standardization, and mapping. This way, you can keep working with the partners you want to work with.

Give your whole enterprise the power to leverage the same data with Cherre’s scalable and flexible data integration and insights platform.

Cherre seamlessly connects any address, geolocation etc. to Cherre's mapped and resolved Data Fabric, enabling you to quickly unify your data and extract actionable insights.

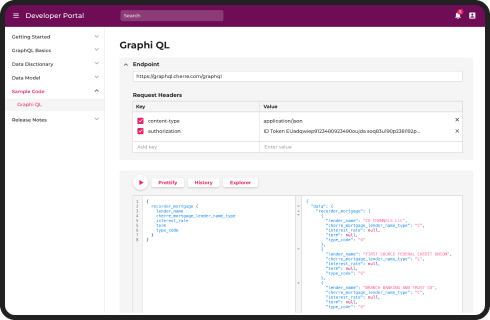

Our data model is always growing, giving you access to the largest real estate data knowledge graph in the world.

Cherre’s Data Fabric consists of mapped and resolved public data that includes property characteristics, recorder and deeds, valuations, tax and assessments, liens and mortgages, boundaries, community and demographics, and POI.

With more than 3.3+ billion addresses and rigorously tested machine learning algorithms, Cherre can connect and aggregate data based on any number of identifiers or geospatial layers - from building and parcel boundaries, to submarkets, to custom boundaries, and more.

Cherre’s schema mapping engine is flexible and configurable, allowing you to map between source and target systems, as well as mapping to Cherre’s standard data model.

Cherre is SOC-2 compliant with strict security and compliance measures built into every layer of Cherre’s platform and process. Your data security is our top priority.

Cherre uses role-based security architecture and confidentiality best practices to protect against unauthorized disclosure of information. We ensure that private information remains private and that it can only be viewed or accessed by individuals who need that information in order to complete their job duties.

Cherre provides protection from unauthorized modifications (e.g., add, delete, or change) of data. Our system provides the highest level of data integrity and we ensure that your data can be trusted to be accurate and that it has not been inappropriately modified.

Cherre ensures that all data is encrypted both at rest and in transit; guaranteeing that all client information is kept secure at all times. Cherre restricts the transmission, movement, and removal of information to authorized internal and external users and processes, and protects it during transmission, movement, or removal.

Cherre’s transparency compliance enable you to meet your regulatory needs. Learn more about Cherre’s security measures and download our security white paper.

Download WhitepaperInstantly deploy in complex and fragmented environments, without giving up any control, visibility, or security.